Investment Decision and Financal Methods In Maritime Business

This article explores the maritime industry's critical role in global trade and its financial dynamics, focusing on the Turkish sector.

M. Özgür ÜSTÜNER

M. Özgür ÜSTÜNER

CEO - Maritime Montering Turkey & Russia

ABSTRACT

This article explores the maritime industry's critical role in global trade and its financial dynamics, focusing on the Turkish sector. Maritime transport, vital for over 90% of logistics, faces challenges such as fluctuating fuel prices, regulatory changes, and geopolitical tensions. Despite these challenges, the industry is expected to grow at a steady rate, with significant capital requirements for vessel acquisition and fleet management. This study examines investment evaluation methods, including NPV, IRR, Profitability Index, and Payback Period, offering insights into effective decision-making. It also highlights financing strategies, such as bank loans, shipyard loans, and government-backed incentives. The research underscores the importance of strategic planning, innovation, and government support for sustainable growth, especially in the context of Turkish maritime companies navigating global market complexities. Key recommendations include strengthening financial strategies, exploring new markets, and prioritizing research and development.

1. INTRODUCTION

Maritime transport, facilitating over 90% of global logistics, is vital for international trade due to its cost efficiency and capacity to handle large cargo volumes (Huang, Tan, and Guan, 2022). Despite its advantages, the industry faces challenges such as fluctuating fuel prices, regulatory shifts, environmental concerns, geopolitical tensions, and market volatility. Companies are adopting risk mitigation strategies and decentralized logistics solutions, including utilizing smaller ports to reduce congestion and operational costs.

The global maritime sector is expected to grow at an annual rate of over 2% from 2024 to 2028 (UNCTAD), presenting opportunities for expansion. However, substantial capital requirements for vessel acquisition, fleet maintenance, and port management necessitate diverse financing approaches, including loans, leasing, private equity, and public-private partnerships. Strategic fund management and resource allocation are essential for competitiveness in this capital-intensive sector. This article explores the global and Turkish maritime landscapes, analyzing regulatory and economic dynamics, risk assessment in maritime projects, and financial options. It emphasizes the importance of innovation, sustainability, and adaptability to navigate market trends like digitalization. By synthesizing global market insights and emerging trends, the research provides strategies for sustainable growth and resilience in the maritime industry.

2. LITERATURE REVIEW

Dan Shneerson (1983) emphasized the profitability of investing in second-hand ships (10-13 years old) and proposed incentives like accelerated depreciation and subsidized loans. Lixian Fan and Meifeng Luo (2023) identified demand growth and charter indices as key factors in liner companies’ expansion, noting shifts toward second-hand ships during high demand. Celik Girgin, Karlis, and Nguyen (2018) advocated using Q theory to optimize firm value by linking ship prices to newbuilding costs, while Kou and Luo (2018) developed a Real Options Approach to determine optimal investment timing, particularly for second-hand ships and lay-ups. Fan, Li, Xie, and Yin (2023) found second-hand vessels preferred for their quick availability in high-demand periods, with larger firms focusing on economies of scale. Akar and Bayar (2021) proposed fuzzy set-based methods for evaluating ship investments under uncertainty, offering a more flexible alternative to deterministic models. Bulut, Yoshida, and Duru (2010) supported fuzzy-TOPSIS for capturing qualitative criteria, favoring Handymax investments over Panamax. Pires, Assis, and Fiho (2012) highlighted the role of real options and managerial flexibility, such as abandonment, using Monte Carlo simulations. Alizadeh and Nomikos (2006) showed dynamic trading strategies improve decisions by linking ship prices to time-charter earnings, while Greenwood and Hanson (2015 warned of forecasting errors leading to overinvestment, stressing accurate demand analysis. Ayşe Aslı Basak (2023) highlighted Turkey’s growing shipping finance sector and the need for a national maritime strategy, and Yusuf Ziya Şipal (2014) recommended adopting the German KG model to renew Turkey’s fleet. Finally, Gümüş (2011) emphasized risk analysis in ship investments, using Monte Carlo simulations to manage volatility.

3. METHODOLOGY

Effective maritime investment decisions require objective analysis beyond intuition. Key factors include the type of commodity, parcel size, and trade route. These influence vessel selection and align with market trends. Systematic numerical methods, rather than subjective judgment, ensure accurate assessments. Upcoming chapters will explore evaluation tools for informed, strategic decisions.

3.1. ELEMENTS OF INVESTMENT PROJECT

Shipping is crucial to global trade, accounting for over 75% of it, with growth expected due to advancements in ship technology. The dynamic nature of global trade presents both challenges and opportunities for shipowners, especially in vessel investments. Key investment factors include costs, hull value, cash flow, and project lifespan (Alizadeh & Nomikos, 2009).

First Disbursement: The first disbursement in maritime investment is the initial funding a company commits to acquire a vessel, covering all costs until it generates its first revenue.

Hulk Value: In the maritime industry, "hulk value" refers to a ship's residual worth at the end of its operational life, often based on its value as scrap or for secondary uses.

Net Cash Inflow: In maritime investments, "net cash inflow" is the ongoing stream of cash received during a vessel's operational life, distinct from earnings, and crucial for assessing a project's financial viability.

Income/Outcome Schedule: In maritime investments, the "income/outcome schedule" outlines the timing of cash inflows and outflows, aiding in liquidity management and maximizing investment profitability.

Life Span: In the maritime industry, a project's life span encompasses all phases of a vessel's operation, crucially impacting financial viability, risk, and long-term investment returns.

3.2. PROJECT ASSESMENT METHODS

As the shipping industry has matured, shipping finance has become more complex, involving advanced financial tools and informed participants. This shift reflects the global market's increasing sophistication, requiring nuanced financing approaches. Four specific assessment methods are highlighted:

1. Net Present Value (NPV)

2. Internal Rate of Return (IRR)

3. Profitability Index (PI)

4. Payback Period

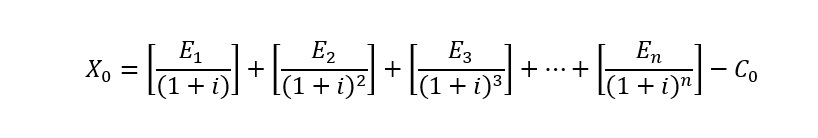

3.2.1 Net Present Value (NPV)

Net Present Value (NPV) measures the profitability of shipping investments by calculating the difference between present values of cash inflows and outflows, factoring in the time value of money. NPV is calculated using the following formula:

Where;

X0: Today’s value of the investment

i: Discount interest ratio

C0: Cost of the investment

n: Life of the investment

E1, 2, 3, …, n: Annual difference of cash inflow and outflow

In shipping investments, a project is deemed acceptable if its Net Present Value (NPV) is positive, with higher NPVs preferred when comparing alternatives. For projects with different lifespans, NPV should be recalculated assuming each project is renewed indefinitely. NPV helps stakeholders assess the profitability of long-term investments like vessels and infrastructure by factoring in future cash flows and the cost of capital.

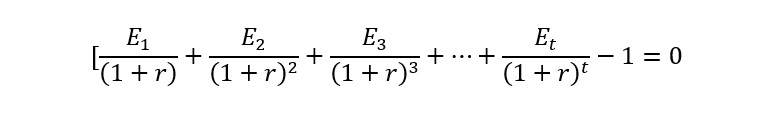

3.2.2. Internal Rate of Return (IRR)

Internal rate of return is a dynamic project assessment method that takes the money’s time value into account. The calculation is similar to the Net Present Value Method. This method specifically emphasizes on the profitability of the investment project. The formula of the method is:

r: Internal rate of return ratio

I: Cost of the investment

t: Life of the investment

E1, 2, 3, …, t: Annual difference of cash inflow and outflow

3.3.3. Profitability Index

The Profitability Index (PI) evaluates investment projects by dividing the NPV of benefits by the NPV of costs, showing the value created per unit of cost. A PI greater than 1 indicates a profitable project. It is particularly useful in comparing projects with different investment scales, helping maritime companies prioritize those with the highest return on investment.

Profitability index = Benefit / Cost

The example in the below gives an idea about this method:

PROJECT A PROJECT B

NPV of Income $15.360.000 $5.000.000

NPV $3.360.000 $1.500.000

Profitability Index 1,28 1,43

3.3.4. Payback Period

The Payback Period is the time it takes for an investment project's income to equal its costs. It is calculated by dividing the total project cost by the annual income. The project with the shortest payback period is considered more advantageous, and the investment is deemed acceptable if it amortizes within the anticipated maximum period. An example using the Payback Period Method is given down below:

Payback Period = Overall Outcome / Annual Income

PROJECT A PROJECT B

Investment Cost $1.500.000 $1.800.000

Economic Life Span 10 years 12 years

Annual Amortization $150.000 $150.000

Profit $60.000 $85.000

Annual Payback $210.000 $235.000

Payback Period (A) = 1.500.000 / 210.000 = 7,14 years

Payback Period (B) = 1.800.000 / 235.000 = 7,66 years

The Payback Period Method prioritizes shorter payback times but doesn't consider economic feasibility or the time value of money. Some companies adjust it by calculating net present values, making it somewhat dynamic.

4. FINANCING MARITIME ORGANISATIONS

Fluctuations in freight rates, bunker prices, asset values, and interest rates complicate risk management in the shipping industry. Shipping companies rely heavily on international bank loans, but also use alternative financing methods like asset-backed mortgages, bonds, private placements, and shipyard financing. Equity financing through retained earnings, public offerings, and mezzanine options are also vital strategies. However, shipping companies face challenges meeting financial community expectations, as they often lack predictable earnings, transparent structures, and audited financials. The speculative nature of shipping investments creates significant financial risks for both owners and lenders. Despite efforts to adopt conventional structures, financing remains complex and challenging in the sector.

The shipbuilding industry is dominated by a few large entities with extensive capital, making it difficult for smaller players to compete. Turkish shipping companies aim to strengthen their position and become influential in the global, capital-intensive maritime market.

4.1. FINANCING METHODS OF MARITIME COMPANIES

1. Financing with Capital Stock: Capital stock strengthens a shipping company's financial foundation, improving its ability to secure loans, protect against instability, and attract investors, ultimately supporting long-term growth in the maritime industry.

2. Bank Loans: Bank loans remain a key method for shipowners to finance vessel acquisitions, involving detailed proposals and negotiations, with the rise of consortium financing sharing risk, while supporting global trade despite challenges in the maritime financing landscape.

3. Shipyard Loans: Shipyard loans, supported by government initiatives to boost national shipyards, are less attractive to shipowners due to long construction timelines and higher interest rates, making bank loans a preferred financing option.

4. World Banks Loans: International development banks, despite complex approval processes, play a vital role in supporting maritime projects in developing countries by evaluating factors like trade volume, economic impact, and market expansion opportunities.

5. Investment Loans From Incentive Funds: Investment loans from incentive funds, backed by government guarantees and offering favorable terms like grace periods and structured repayments, provide vital financing for shipbuilding projects, supporting the growth and modernization of the maritime industry.

6. Investment Service Incenrive Funds: The Investment Service Incentive Fund provides financial support to help complete unfinished shipbuilding projects that were initiated with government incentives, offering structured repayment plans and clear eligibility criteria to ensure efficient project completion.

7. Leasing: Leasing in maritime finance allows shipowners to use vessels without upfront costs, offering flexibility and tax benefits, but involves risks such as revenue, operating, and residual value risks, with the structure depending on whether it's an operating or finance lease.

5. CONCLUSION

The Turkish maritime sector faces significant challenges due to unplanned fleet expansion driven by rising demand, leading to overcapacity and financial instability during economic downturns. The global economic crises of the past, such as in 2008, exposed the risks of aggressive growth without contingency planning, leaving smaller shipyards vulnerable. Despite this, Turkey's maritime companies maintain strong creditworthiness globally, aided by government support such as loan repayment assistance. However, the sustainability of this support is uncertain in the long term, making it crucial for companies to adopt strategic approaches.

Recommendations for maritime companies include negotiating lower interest rates, extending loan repayment deadlines, and engaging with international financiers to secure investments. Additionally, exploring new markets in transitional economies, like Russia, and understanding competitors' performance can help mitigate risks. Shipyards, especially in Tuzla, need to diversify their production, focusing on vessels of greater tonnage and advanced technologies to stay competitive.Government support plays a key role in this transition, fostering innovation and developing expertise in building advanced ships. Maritime companies must also prioritize research and development, improving operational efficiency and sustainability. Long-term planning, collaboration, and innovation will enable the sector to thrive despite economic fluctuations. By fostering partnerships, sharing knowledge, and raising awareness of the sector’s economic significance, the Turkish maritime industry can strengthen its global position. Strategic growth, supported by informed decision-making and government assistance, will allow companies to adapt and emerge stronger in a dynamic global marketplace.

REFERENCES:

Akan, E., & Bayar, S. (2021). An evaluation of ship investment in interval type-2 fuzzy environment. Journal of the Operational Research Society, 73(8), 1768–1786. https://doi.org/10.1080/01605682.2021.1944826

Akca E. C. (2006). Basic Maritime Fincance. (Master’s thesis) Istanbul University Institute Of Marine Sciences And Management.

Akcadag, M. (2022). EVALUATION OF WORLD AND TURKEY TRANSPORTATION DATA IN TERMS OF MARKETING ACTIVITIES. Güncel Pazarlama Yaklaşımları ve Araştırmaları Dergisi, 3(2), 109–121. https://doi.org/10.54439/gupayad.1188944

Alizadeh, A. H., & Nomikos, N. K. (2006). Investment timing and trading strategies in the sale and purchase market for ships. Transportation Research Part B Methodological, 41(1), 126–143. https://doi.org/10.1016/j.trb.2006.04.002

Aymutlu E. (2007). Financing Structure Of The Maritime Sector In The World And In Turkey. (Master’s thesis) Marmara University Institute of Social Sciences, Department of Economics

Başak A. A. (2023). Ship Investment Strategies in Fluctant Shipping Market Condition: Turkey’s Perspective. (Master’s thesis). Yeditepe University Graduate School of Social Sciences

Bulut, E., Yoshida, S., & Duru, O. (2010). Multi-attribute analysis of ship investments under technical terms: a fuzzy extended TOPSIS approach. IEEE, 23, 193–197. https://doi.org/10.1109/iccae.2010.5451481

Fan, L., & Luo, M. (2013). Analyzing ship investment behaviour in liner shipping. Maritime Policy & Management, 40(6), 511–533. https://doi.org/10.1080/03088839.2013.776183

Floriano C. M. Pires. “A Real Options Approach to Ship Investment Appraisal.” AFRICAN JOURNAL of BUSINESS MANAGEMENT, vol. 6, no. 25, 27 June 2012, https://doi.org/10.5897/ajbm11.2794.

Girgin, Sinem Celik, et al. “A Critical Review of the Literature on Firm-Level Theories on Ship Investment.” International Journal of Financial Studies, vol. 6, no. 1, 19 Jan. 2018, p. 11, https://doi.org/10.3390/ijfs6010011.

Greenwood, R., & Hanson, S. G. (2014). Waves in ship prices and investment *. The Quarterly Journal of Economics, 130(1), 55–109. https://doi.org/10.1093/qje/qju035

Gumus U. T. (2011). Financial Valuation Of Ship Investments As A Risky Investment Project: Simulation Approach. (Master’s thesis) Adnan Menderes University Institute of Social Sciences.

Kou, Y., & Luo, M. (2018). Market driven ship investment decision using the real option approach. Transportation Research Part a Policy and Practice, 118, 714–729. https://doi.org/10.1016/j.tra.2018.10.016

Senturk U. (1999). Financial Analysis And Mathematical Modeling Of Ship Investment. (Master’s thesis). Istanbul Technical University Institute Of Science.

Shneerson, D. (1983). THE PROFITABILITY OF INVESTMENT IN SHIPPING. THE BALANCE OF PAYMENTS CRITERION. Journal of Transport Economics and Policy. https://trid.trb.org/view/417416

Sipal Y. Z. (2014). Shıp Investment Strategies And Finance Of Companıes In The Maritime Transportation Sector In Turkey; One Application. (Master’s thesis). Adnan Menderes University Institute of Social Sciences

Ozdemir, Ü. (2015). TARİHTE TÜRK DENİZCİLİK FAALİYETLERİ VE GÜNÜMÜZ LİMANLARININ GELİŞİM SÜRECİNE OLAN ETKİSİNİN İNCELENMESİ. ODÜ Sosyal Bilimler Araştırmaları Dergisi (ODÜSOBİAD), 5(12), 421–441. https://arastirmax.com/en/system/files/dergiler/260420/makaleler/5/12/arastirmax-tarihte-turk-denizcilik-faaliyetleri-gunumuz-limanlarinin-gelisim-surecine-olan-etkisinin-incelenmesi.pdf

Turkish Chamber of Shipping (DTO). Maritime Industry Report. Istanbul 2023.

Turkish Ship Yacht and Marine Services Exporters’ Associaton, Annual Export Report 2023.

Turkish Shipbuilders’ Association (GISBIR), Shipbuilding, Maintenance-Repair Sector Statistical Data for 2021-2022

United Nations Conference on Trade and Development (UNCTAD), Review of Maritime Transport 2023.

Varisli C. (2015). Maritime Finance And Marine Insurance In Turkey And In The World. (Master’s thesis) Istanbul Technical University Institute of Science.

Xu, J. J., & Yip, T. L. (2012). Ship investment at a standstill? An analysis of shipbuilding activities and policies. Applied Economics Letters, 19(3), 269–275. https://doi.org/10.1080/13504851.2011.572842

HABERE YORUM KAT

Türkçe karakter kullanılmayan ve büyük harflerle yazılmış yorumlar onaylanmamaktadır.